For Online Entrepreneurs Looking To Lower Taxes Legally

new Playbook reveals little-known Secret That Smart online business owners Are Using to pay 0% taxes without Stress and complex setups

Unlock the U.S. Tax Loophole Every Smart Digital Entrepreneur is Using to Scale Faster, Keep More, and Remove the Stress of Taxes from their Business

If You're Watching 30-50% of Profits Disappear in Taxes while Running an Online Business... This Strategy Shows You How to Stop the Drain (Legally)

Only $47 • Save $150 Today • Instant Access

14-day money back guarantee

Real Results for over 650 clients Globally

Matt knows his stuff Deep

★★★★★

If you're a non-US citizen and need help setting up a US LLC, opening bank accounts (very good ones!), or figuring out different credit strategies, he’s your guy. He knows this stuff inside out and shares practical advice that actually works. He made the whole process super simple and removed all guesswork and trial and error for me. Can’t recommend him enough! 👍

Kurosch Khazaeli 🇩🇪

Marketing Consultant

Verified Customer

Total clarity and trust

★★★★★

Robert Cracknell 🇨🇦

Software Developer & RE Investor

Verified Customer

From confusion to clarity

★★★★★

Had lots of questions which were thoroughly answered, taking me from a place of confusion to absolute clarity. Tax is tricky and even my own accountants just made things more confusing and had little answers but after one consult with Matt I was able to have all my questions answered and enough of an understanding to confidently move forward with my international tax strategies.

Tyler R. 🇦🇺

E-commerce Store Owner

Verified Customer

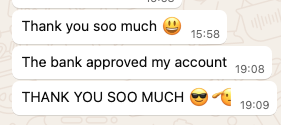

The process was smooth

★★★★★

David went from high tax pressure to a new simple setup, getting his LLC with an active bank account and payment gateway in less than 48 hours.

David St Germain 🇨🇦

Sales Consultant

Verified Customer

Efficiency and knowledge

★★★★★

Helped him with multiple LLCs setup for worldwide tax optimisation with global bank accounts and worldwide payment processing.

Wojciech K. 🇵🇱

Serial Entrepreneur & Investor

Verified Customer

You’re In The Right Place if...

✅ You’re a Non-US citizen living outside the United States

✅ You run a digital business (agency, consulting, coaching, ecommerce, digital products, etc.)

✅ You want a stress-free system

✅ You’re tired of “local structures” that create complexity

✅ You want control, leverage, and simplicity (and freedom)

Already used by 650+ entrepreneurs across the globe:

🇨🇦 Canada 🇬🇧 UK 🇦🇺 Australia 🇩🇪 Germany 🇵🇱 Poland 🇫🇷 France 🇪🇸 Spain 🇵🇹 Portugal 🇮🇹 Italy 🇧🇷 Brazil 🇫🇮 Finland 🇨🇭 Switzerland 🇬🇪 Georgia 🇺🇾 Uruguay 🇲🇽 Mexico 🇳🇱 Netherlands 🇹🇷 Turkey 🇵🇭 Philippines 🇲🇾 Malaysia 🇮🇳 India 🇰🇷 South Korea 🇪🇬 Egypt 🇧🇪 Belgium 🇷🇴 Romania 🇲🇩 Moldova 🇩🇰 Denmark 🇳🇴 Norway 🇬🇷 Greece 🇸🇮 Slovenia 🇪🇪 Estonia 🇹🇼 Taiwan 🇿🇦 South Africa and more

Overwhelmed by taxes?

You’re not the only one.

Hey there, fellow entrepreneur,

Remember when you first launched your online business?

The freedom, the excitement of finally being your own boss...

You probably thought, "This is going to be life-changing!"

Fast forward to now:

Taxes, forms, and legal demands start piling up... and you're paying more than you ever expected.

Those late-night thoughts about audits, complicated forms, and surprise expenses just don’t stop showing up.

And figuring out how to scale while the system keeps pulling more? That’s a headache of its own.

Sounds familiar? It’s the same storm most online founders get caught in.

Secure checkout – 14-day money back guarantee

But before we dive in 👇

Let’s address the massive elephant in the room...

You’ve probably tried everything, right?

Hiring expensive accountants 💸

Setting up a complicated business structure in your home country 🏛️

Even moving money around in ways that make your head spin 🌀

If you’re like most online entrepreneurs, you probably ended up with:

1. An accountant who charges a fortune, but your tax bill barely moves💰

2. A business structure that’s such a mess that taking the first step feels impossible… 🤯

3. Tax bills that seem to grow every year, no matter what you do 📈

And let’s not forget the “expert” solutions:

That high-priced tax advisor with the pricey offshore plan? Complicated, expensive, and not worth the chaos ✈️

The complex tax schemes that only brought you more paperwork—and more headaches 😖

The offshore account setup that cost more than your first year’s revenue and left you questioning if it was even worth it 🚗💨

The tax system isn't trying to ruin your business.

It's just playing by rules you don't fully understand (yet)

...but what if you could? 👀

The Key: A Simple U.S. LLC

Access U.S. Market

US are one of the world's largest economies. Get stronger credibility and market access opportunities and partners.

INCLUDED

Protect Your Privacy

Explore how your ownership info can remain shielded from public domain and disconnected from the business.

INCLUDED

Secure Your Assets

Your personal belongings will be protected from business liabilities, keeping your wealth safe.

INCLUDED

Minimal Taxes

Discover how to legally structure your business to optimize for minimal tax obligations.

INCLUDED

Maximum Flexibility

No need for boards, accounting or bookkeeping. Manage your LLC with ease and control (and stress-free).

INCLUDED

No Double Taxation

Explore how strategic management of an LLC could help minimize personal tax exposure (even in high-tax jurisdictions)

INCLUDED

International Investor Appeal

Structure trusted worldwide, improving your position for investment opportunities from U.S. and international sources.

INCLUDED

Access US Banking

Easily open U.S. bank accounts and gain access to American financial system to protect your wealth.

INCLUDED

Low Setup Costs

Learn the simple way to set up and maintain your LLC with ease and minimal fees.

INCLUDED

No U.S. Residency Needed

Set up a U.S. LLC designed to work from anywhere, with minimal tax exposure.

No need for physical presence or U.S. residency or citizenship.

Run your tax-free U.S. LLC from anywhere in the world, without the need for physical presence or U.S. citizenship.

INCLUDED

Secure checkout – 14-day money back guarantee

I get it. You’re skeptical.

Others were thinking:

"I've tried all kinds of ways to reduce my tax load, and still didn’t get real results. So how can a U.S. LLC change the game?" 💼❌

"With all the complexity in my country’s tax rules, I wasn't even sure if using a U.S. LLC was a legal option for me." 🌍💸

"Running a business, serving clients, and juggling everything else doesn’t leave much room for dealing with complicated setups. Is launching an LLC even doable with a packed schedule?" ⏰😫

"Some tax strategies out there feel risky or unclear. I wondered if setting up a U.S. LLC create issues with my local laws?" ⚖️😟

"My tax burden keeps increasing year after year, no matter what adjustments I try. Can a U.S. LLC really offer a way to change that pattern?" 📉🤔

Trust me, I’ve been there.

There was a time when tax bills, audits, and endless paperwork took over my focus.

It felt like the paperwork never stopped, and the questions never ended.

I remember staying up late trying to figure out how to make sense of it all.

And the truth is I lost more hours to tax stress than I’d like to admit.

Wondering if growth was even possible while the system kept taking more and more.

It felt like every time I tried to scale, a chunk of the profit would disappear into taxes.

Building the business was one thing... keeping more of what I earned was another challenge entirely.

In The No-Tax Strategy you’ll discover

The "U.S. Tax Code Decoder" – Uncover how to legally reduce your tax liability to near-zero by understanding key LLC benefits and regulations.

The "State of Incorporation Strategy" – Learn which U.S. states offer the most tax-friendly options and how to choose the right one for your LLC.

The "Audit-Safe" Blueprint – Master the steps to ensure your LLC is fully compliant, so you can avoid red flags and sleep soundly.

The "Expense Optimization Method" – Maximize your deductions and keep more of your income without needing a complicated offshore structure.

The 5-minute "Setup System" – A simple, step-by-step guide to get your U.S. LLC up and running quickly, with minimal hassle.

The "International Tax Advantage" Approach – Learn how a U.S. LLC can help you avoid paying taxes in both your home country and the U.S.

The "Revenue Protector" Guide – Discover how to shield your profits from unnecessary taxes and reinvest them into scaling your business.

Stress-free Filing Techniques – Get rid of tax headaches with easy compliance strategies that simplify your annual filing requirements.

The "Peace of Mind" Toolkit – Learn how to structure your LLC for ultimate protection against legal risks and unexpected claims.

The "LLC Playbook" – Master the exact process for setting up a U.S. LLC that allows you to legally cut on taxes, while still scaling your business globally.

Secure checkout – 14-day money back guarantee

Everything You Need to Reduce Taxes, Gain Control, and Legally Protect Your Profits — In One Proven Framework

This isn’t your typical loophole guide.

This approach is based on a simplified legal structure that’s helped over 600 digital entrepreneurs reduce or eliminate tax burdens, when applied properly. 🧠

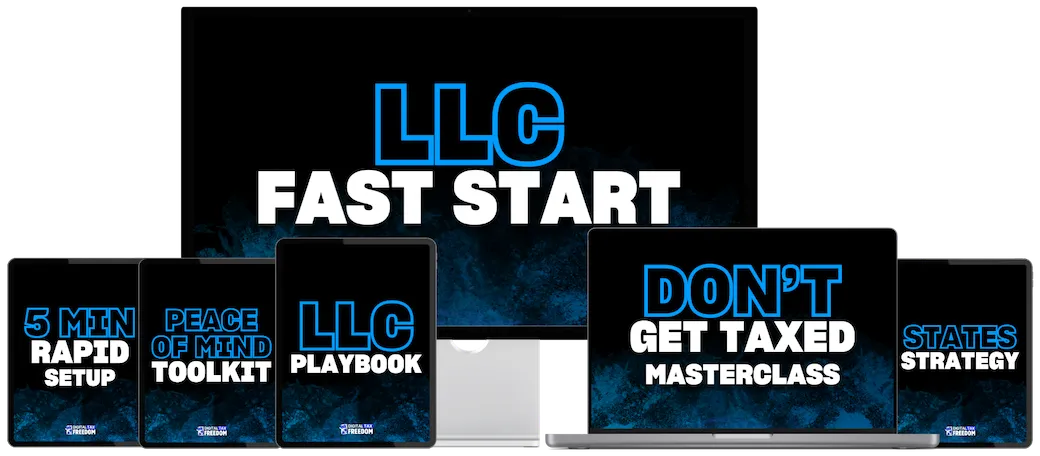

Here's everything you're getting for Just $197 $47.00 Today

You get the full system + shortcut bonuses to make execution fast, safe, and stress-free.

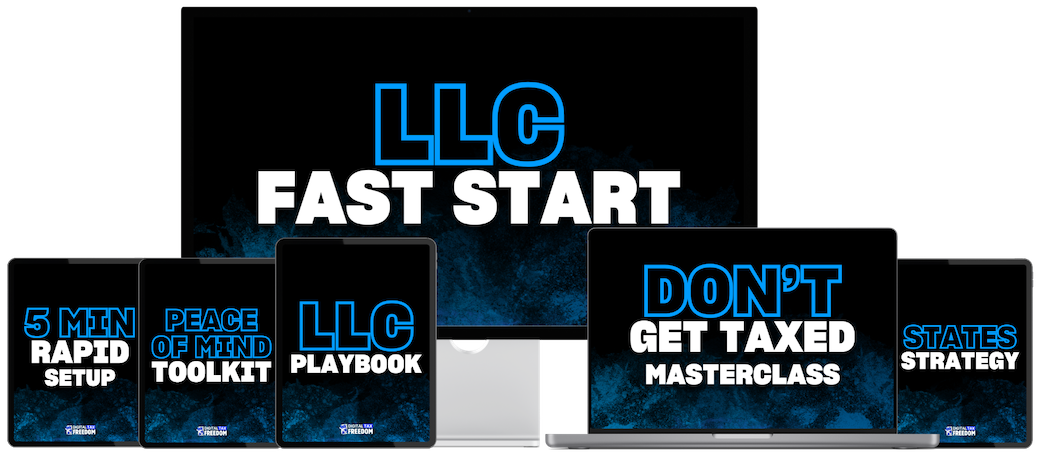

The LLC Playbook

(Digital PDF Download)

The first comprehensive playbook that explains how to design a digital business structure with strategic tax benefits.

INCLUDED

LLC Fast Start

(Video Training)

Everything you need to know about the U.S. LLC to run a lean business designed for low overhead and potential tax advantages.

INCLUDED

Don't Get Taxed Masterclass

(Spreadsheet)

A complete masterclass where you will find out all the common mistakes that could cause you to lose your 0% tax benefit.

INCLUDED

5 Min Rapid Setup

(Digital PDF Download)

Learn the quickest and easiest way to create your LLC, and all the mistakes to avoid, to be ready in less than 7 days.

INCLUDED

Peace of Mind Toolkit

(Video Training)

Find out what annual obligations you need to follow to stay compliant and keep your LLC healthy.

INCLUDED

States Strategy

(Video Training)

Learn how to choose the best state to incorporate your LLC that fits your business needs and future plan.

INCLUDED

All This For Just $47

That's less than the cost of one sleepless night of lost productivity 💸

Secure checkout – 14-day money back guarantee

Why The U.S. Is The #1 Legal Tax Haven For Global Digital Nomads & Entrepreneurs

Non-residents can structure a U.S. LLC for potential tax advantages, if set up and handled the right way. But with the right structure, it’s possible.

This isn’t about finding another complicated loophole.

It’s about using a simple proven, legal framework that allows you to take full advantage of the U.S. tax system – completely stress-free.

And reduce your tax burden to zero legally, so you can focus on your business

What Clients are saying...

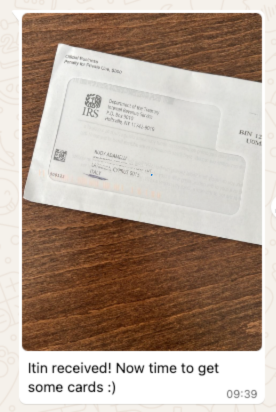

Got my LLC and ITIN fast and simple

★★★★★

Rudy Adamelli 🇮🇹

E-commerce Store Owner

Verified Customer

Others just made me more confused

★★★★★

Leo Carey 🇦🇺

Sales Consultant

Verified Customer

I can really recommend it

★★★★★

He is very professional and takes care of the details. He provides a lot of value in the course. I was able to avoid a lot of mistakes and start easily!

Dave Nass 🇩🇪

Business Consultant

Verified Customer

This guy is a genius

★★★★★

This guy is a genius with the topic.

I most definitely recommend him because he really knows what's he's talking about.

Yannick Levesque 🇨🇦

Branding Consultant

Verified Customer

Total clarity

★★★★★

Matt’s course and consultation bring total clarity and he’s direct to the point.

He’s clearly done this many times and I trust him fully with supporting my process. Thanks Matt.

Jamie Divine 🇦🇺

Marketing Consultant

Verified Customer

Matt has been a godsend

★★★★★

Tahj Howell 🇨🇦

Fitness Coach

Verified Customer

From +$200K in tax debt… to having hope again

★★★★★

Scott S. 🇨🇦

Marketing Consultant

Verified Customer

Efficiency and knowledge

★★★★★

Helped him with multiple LLCs setup for worldwide tax optimisation with global bank accounts and worldwide payment processing.

Wojciech K. 🇵🇱

Serial Entrepreneur & Investor

Verified Customer

One word: amazing

★★★★★

High quality content and support, it delivers more than it promises, if I could use just one word to define it it would be "amazing".

Diogo Nascimiento 🇧🇷

Software Developer

Verified Customer

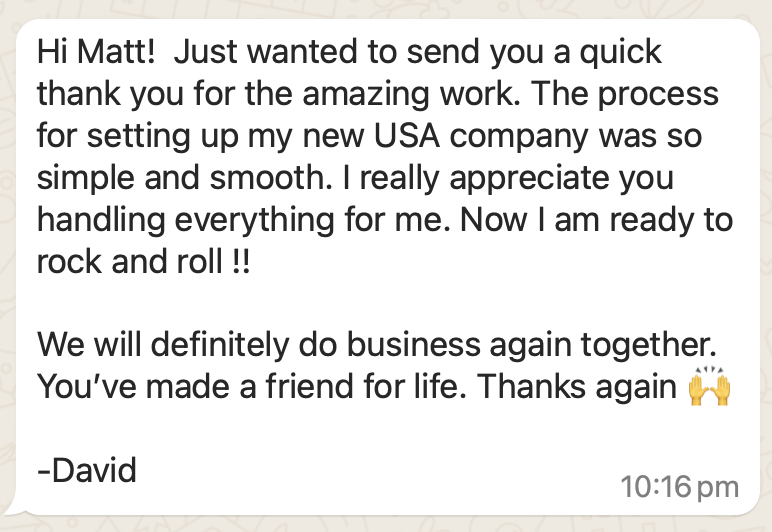

You've made a friend for life

★★★★★

LLC + U.S. bank + Stripe ready in 48h.

David St Germain 🇨🇦

Sales Consultant

Verified Customer

Absolute game-changer

★★★★★

It was an absolute game-changer for me.

The course provided clear, step-by-step guidance on the entire process, breaking down complex legal and tax concepts into easy-to-understand lessons.

This saved me hours of research and potential headaches, giving me the confidence to move forward without confusion or costly mistakes. Matt’s expertise and ability to simplify what can often be an overwhelming process made this course well worth the investment. If you’re a non-U.S. resident considering forming an LLC in the U.S., It’s a must-have resource!

Yujin Yeoh 🇦🇺

Marketing Agency Owner

Verified Customer

Highly recommend this!

★★★★★

Matt's Digital Tax Freedom course is a game-changer for anyone looking to establish an LLC in the US ad a non-citizen. The course gives clear actionable steps on how to set up the company efficiently.

I also booked a consultation with Matt, which proved to be incredibly beneficial. He provided a wealth of useful insights that have greatly informed our approach to structuring our business going forward.

I highly recommend this course and his services!

Kristiina V. 🇫🇮

Amazon Shop Owner

Verified Customer

Couldn’t be more impressed

★★★★★

Professionalism, expertise, and dedication. Navigating the complexities of cross-border taxation can be overwhelming, but Matt made the process seamless and stress-free. Matt was always responsive, patient, and willing to go the extra mile to ensure I understood every step of the process.

I highly recommend Matt to anyone seeking a knowledgeable and reliable international tax structure advisor. Whether you are an expatriate, a business owner, or managing global investments, you can trust them to deliver outstanding results.

Len Onekeo 🇨🇦

Software Developer

Verified Customer

Matt has been a godsend

★★★★★

Very knowledgeable, experienced, and up to date with trends and tax rules. Spoke with Matt personally. He really tries his best to help.

Thomas Chee 🇦🇺

Marketing Agency Owner

Verified Customer

Provided valuable insights

★★★★★

Matt has been very responsive and provided valuable insights.

I appreciate his expertise and guidance.

Paula Knight 🇨🇦

Health Coach

Verified Customer

He opened up my mind

★★★★★

Matt truly is a master of finding the correct taxing structure and also goes out of his way to help. Through his course and our messages, he opened up my mind to a whole new level of tax structure. (And I'm an ex-startup founder who understand these things, or thought I did!). Highly recommended, you can't go wrong. Thanks again!

Aaron G. 🇹🇷

Mindset Coach

Verified Customer

From confusion to clarity

★★★★★

Had lots of questions which were thoroughly answered, taking me from a place of confusion to absolute clarity. Tax is tricky and even my own accountants just made things more confusing and had little answers but after one consult with Matt I was able to have all my questions answered and enough of an understanding to confidently move forward with my international tax strategies.

Tyler R. 🇦🇺

E-commerce Store Owner

Verified Customer

Knowledge and experience

★★★★★

For many, tax-related topics can feel like a hassle, but for Matt, it’s a different story! His passion and enthusiasm for taxation shine through, making him truly stand out. With a wonderful blend of theoretical knowledge and practical experience, he’s an invaluable resource you won’t want to overlook. I wholeheartedly encourage you to connect with Matt for tax-related advice that can simplify your life!

Matthias B.🇨🇭

Amazon Shop Owner

Verified Customer

He opened up my mind

★★★★★

When our first online store exploded, we started looking for a real expert to help us set everything up for zero fees and maximum freedom and flexibility.

And that's where we met Matt, recommended by a friend of ours.

And I must say that to date he has been one of the best choices we have made. Today we have a totally legal setup that allows us to continue to scale our e-commerce while we can travel, pay zero taxes legally, and even get the best credit cards in the world!

Gabriele P. 🇮🇹

E-commerce Store Owner

Verified Customer

Really positive experience

★★★★★

Timotej F. 🇬🇪

Marketing Agency Owner

Verified Customer

Secure checkout – 14-day money back guarantee

Totally Risk Free With our 14 days money back guarantee

We’re confident this strategy can give you the clarity and direction to structure your taxes more efficiently. That’s why we back it with a 14-day money-back guarantee.

If after going through our step-by-step process you don’t feel like it’s moving you closer to real tax savings, just shoot us an email and we’ll refund your $47. No hoops. No hassle.

And of course, everything you’ve already learned is yours to keep. You’ll still have full access to the insights and bonus material worth well over $197.

Use them to grow smarter, protect what you’ve earned, and keep more of your revenue where it belongs: in your business.

Secure checkout – 14-day money back guarantee

Here's Everything You’re Getting For $197.00

Just $47 Today

Here's Everything You’re Getting For $197.00 Just $47 Today

LLC No-Tax Strategy

THE LLC PLAYBOOK

Free Bonus: LLC Fast Start ($97.00 Value)

Free Bonus: Don't Get Taxed ($97.00 Value)

Free Bonus: 5 Min Rapid Setup ($97.00 Value)

Free Bonus: Peace of Mind Toolkit ($97.00 Value)

Free Bonus: States Strategy ($97.00 Value)

$197 Just $47.00 Today

Secure checkout – 14-day money back guarantee

But fair warning. This is a Limited-time opportunity

Just like those tax-saving strategies that seem too good to be true and then vanish, this deal could disappear at any moment. ⏳

Click the “Get Instant Access” button now.

Your business, your profits, and your peace of mind will thank you.👇

Secure checkout – 14-day money back guarantee

P.S. Still on the fence?

Remember, you’re just one click away from discovering how hundreds of founders are using this strategy to cut tax pressure and grow profitably

...and finally escape the never-ending stress of overpaying on taxes.

Don’t let another year of unnecessary tax payments drain your business. 💼💸

One click could change the way you think about taxes... forever.

Frequently Asked Questions

How can an LLC help me minimize tax obligations?

A U.S. LLC isn’t just another company. For online entrepreneurs, it’s often the setup that finally makes everything click.

If you run a digital business, a U.S. LLC could be one of the most effective ways to scale globally, with simplicity and flexibility built-in, that perfectly suits online businesses, freelancers, agencies, ecommerce stores, self publishers, dropshippers, or people that are generally selling services like consulting, infoproducts, done for you and much more.

Used the right way, this strategy can create a path to legally reduce taxes to near-zero, without complexity.

If you’re not a U.S. resident, the legal framework may allow for a U.S. LLC setup that minimizes or avoids taxation, when done correctly.

Is it legal to open a U.S. LLC?

Yes. Having a U.S. LLC is completely legal no matter what country you are a resident or citizen of. All states allow their citizens to open companies in foreign states wherever they prefer.

Do I need to be a U.S. citizen or resident to open an LLC?

To qualify for an LLC for potential tax benefits, you do NOT have to be a U.S. citizen or resident.

What are the advantages of opening a U.S. LLC?

Using an American LLC to grow your business has several advantages, especially for those with a digital business:

- U.S. LLCs formed by non-residents can, under specific conditions, operate with near-zero tax liabilities.

- Privacy by design: structures like these can avoid revealing personal ownership on public databases

- Extreme ease of management: the LLC does not require you to create and manage invoices. It is not required to keep accounts and has no special bureaucratic obligations, like the usual European companies.

- Total protection of your assets: an LLC, from a legal point of view is exactly like a limited liability company. This means that in case of legal disputes, your personal assets as owner or your assets, cannot be attacked.

- U.S. and global market access: an LLC is an entity that provides access to all central platforms of global digital commerce. Therefore it is a recommended solution for those who want to sell online, or offer services worldwide, and want to use the best platforms to do so.

Can I get paid by US companies and/or customers?

Yes, you can sell to other US companies and/or customers through your US LLC. Many of our clients are using this to work with American companies, sell to American people, or get paid by U.S.-based platforms such as Upwork, Fiverr and similar.

A U.S. LLC lets you get paid by U.S. companies and platforms, while maintaining favorable tax treatment.

Can I do this if I live in the US with a LLC in another state?

No, this opportunity is only avabile to Non-US residents.

Secure checkout – 14-day money back guarantee

LEGAL DISCLAIMER

IMPORTANT - PLEASE READ CAREFULLY:

The information contained in this course is provided solely for general educational and informational purposes and does not constitute professional advice of any kind, including but not limited to legal, tax, financial, or business advice.

We are not tax advisors, attorneys, or accountants. The strategies and concepts discussed in this course are presented as educational material and are not intended to substitute for advice from qualified professionals.

BEFORE taking any action based on the information in this course, it is STRONGLY RECOMMENDED that you consult with a licensed accountant, tax advisor, attorney, or other qualified professionals who can provide advice tailored to your specific situation.

Results may vary. We do not guarantee specific results, and every tax situation is unique. Tax laws are complex and subject to change. What is legal in one jurisdiction may not be legal in another.

The author and publisher of this product make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of the information contained herein for any specific purpose.

The use of this course does not create an accountant-client, attorney-client, or other advisory relationship between the reader and the author or publisher.

You are solely responsible for your decisions and the actions you take. The author and publisher expressly disclaim any and all responsibility for any consequences that may arise from the use of the information provided herein.

Always consult with a qualified professional before implementing any tax strategy.